Dish is buying the satellite network operator it once owned, in an all-stock deal valued at around $4bn

Billionaire Charlie Ergen has decided to consolidate his telecommunications empire, merging his satellite and broadband services companies Dish Network and EchoStar in an all-stock deal.

Ergen, who co-founded Dish, owns more than half of its outstanding shares and owns nearly 60% of EchoStar. Dish had a market value of $4.07 billion as of Monday’s close, while EchoStar’s market value was $1.97 billion, according to Refinitiv data.

The merger reunites EchoStar with its former parent, which spun off the business in 2008. However, the two companies’ fortunes have varied widely since. While EchoStar’s shares have risen by almost 15% in the past 12 months, Dish shares have dropped nearly 60% as investors fret over its debt levels and over-reliance on a shrinking base of satellite TV subscribers.

Since the spinoff, Dish has bought several assets from EchoStar, including its broadcast satellite service, while EchoStar has focused on satellite communications, such as its Hughes subsidiary’s consumer internet service.

Recon Analytics analyst told Bloomberg the deal was “purely a financial move, which will give Dish a little more help in the credit market.”

“The transaction is predominantly about Dish getting access to the $1.7 billion of cash at EchoStar,” New Street Research analyst Jonathan Chaplin told Reuters. “In addition to bolstering its liquidity, the combination will improve leverage for Dish.”

This is a strategically and financially compelling combination that is all about growth and building a long-term sustainable business,” said Ergen. “DISH’s substantial past investments in spectrum and its wireless buildout, combined with EchoStar’s recent launch of JUPITER 3, are expected to significantly reduce near-term CAPEX requirements.”

Wireless proving expensive

Dish — which owns Boost Mobile, Ting, Republic Wireless and Gen Mobile — has been trying to expand beyond satellite TV into the mobile telecom market, with its Dish Wireless business. The company said its 5G network now covers more than 70% of the US and it has also expanded into streaming TV services, through its Sling TV subsidiary.

But Dish has essentially been cut off from the debt market as rates have risen. According to Bloomberg, credit analysts had estimated that Dish would need as much as $16bn in new capital between 2024 and 2026 to cover spending, wireless costs and address upcoming debt maturities.

Bloomberg Intelligence analysts John Butler and Hunter Sacco wrote that the merger would provide Dish with access to cash to advance its 5G buildout after Ergen’s plan to tap the debt markets for financing was derailed by rising interest rates.

Ergen could gain access to EchoStar’s $1.9bn in cash and nearly $265mn in free cash flow expected this year, based on consensus, assuming the deal is approved.

EchoStar CEO Hamid Akhavan will lead the combined company, and Ergen will serve as executive chairman, according to the statement. Erik Carlson, the CEO of Dish and a 15-year veteran of the company, will step down when the transaction closes by the end of the year.

Last month, Echostar signed multi-year commercial agreements with seven European IoT service providers to sell solutions using its pan-European, satellite-based, LoRa-enabled network.

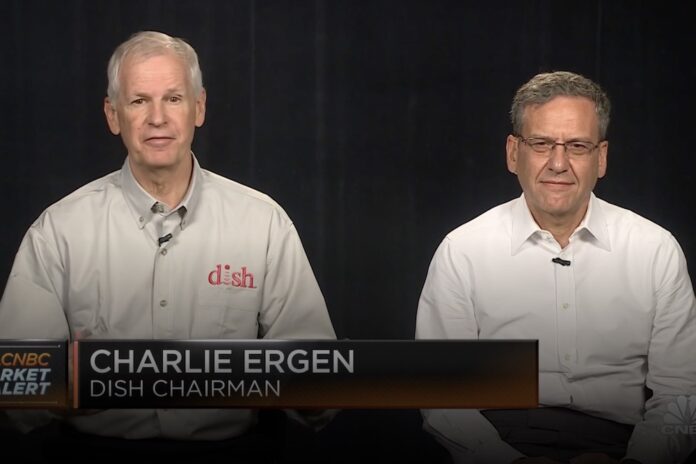

Pictured: Dish and Echostar chairman Charlie Ergen (left) and CEO Hamid Akhavan talk to CNBC.