Alcatel-Lucent has announced a major Customer Experience Management (CEM) software launch. Bundling existing BSS and OSS software with a variety of new packages, the company is aiming its Motive Customer Experience Solutions (CXS) portfolio squarely at the growing need within operators to reduce churn and increase revenues by improving all aspects of the customer experience.

Greg Owens, Director, Customer Experience Solutions Marketing, Alcatel-Lucent said, “We are launching a brand new portfolio to help service providers define and execute on their CEM strategies.

“We’ve taken our existing assets and brought them into one unified portfolio in the company. We’ve also recognised that we have had gaps and we’ve filled those with some active investments in new technology.”

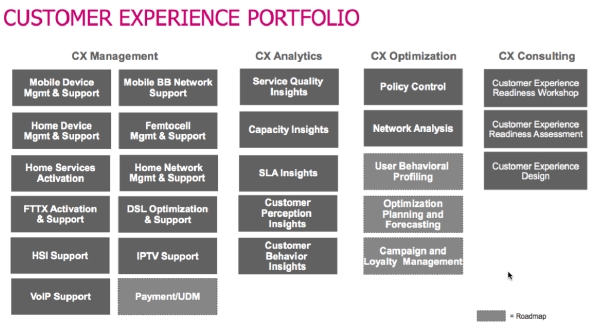

CSX is formed of four main elements, Management, Analytics, Optimisation and Consulting. (See left) Each suite contains existing Al-Lu software and a few new elements.

Owens said that new elements included the mobile device management and mobile broadband network packages within the CX Management suite. The CX Analytics suite also has new its elements: with its Customer Behaviour Insights and Perception Insights being based on “new algorithms” developed by Bell Labs.

Me too from Al-Lu?

So is Al-Lu following the herd with its CEM strategy, or is it attempting something different? NSN is already very active in highlighting the strategic importance of its CEM software both for its customers and for its own business, and Ericsson and Huawei are also expected to make CEM launches before or at MWC.

Owens said, “The way we are going to market is very different to the way NSN and Huawei and Ercisson think of [CEM]. We do think we are unique in this space. We think a lot of companies take a narrow perspective: they want to talk about this in the context of the network, and we say it’s about the customer. They want to talk about in the context of mobile, and we also think it’s about what happens at work and home as well.”

Owens added that this is not a market that Al-Lu has come to lately. “CEM is something that we have always been interested in; we have been in this area for the better part of last 12 years,” he said.

Owens added that operators were at an inflexion point in the market because a “sea change of events” happening at the same time hasmeant that “the things they relied on to compete and win no longer work.”

To respond, operators are recognising they need to move from a growth-based “land grab” to a model that focuses on customer attention and retention. And to do that they need software tools that allow them to analyse their network data, their device and application level data and to make sense of that to different business units within the operator, including marketing, CRM, technical and networks units.

The breadth of Al-Lu’s portfolio will be a key strength, Owens said. Although many operators are creating a CEM advocate or chief CEM officer, responsibile for CEM delivery across the business, all operators have different requirements and start from different places, he added.

“Our portfolio allows us to walk into an executive who is charged with making sure CEM strategies filter through the whole organisation and say that we can collaborate with you to build that vision and strategy. We can go to different business teams with nimble and flexible solutions that we can work into their business processes based on that day’s immediate needs.”

So what does Owens make of operators’ attempts to transform their CEM capabilities to date?

“I think they will all tell you that they are in a great position to own the customer experience and that they want to own it, but they will also say they have lots more options to explore and innovations to make to truly capture the voice of the customer. There’s much more they can do in the context of improving the channels they’ve already established.

“The thing they are struggling with the most is that CEM change requires a broad initiative that impacts every employee in the business, so they have to get around the organisational challenges. But by no means are they sitting back. Our perspective is that this is a crawl, walk, run process and we expect material advances by the end of the year.”