MTN Consulting looks at what is shaping the landscape and predicts things will be better in 2025

MTN Consulting has published an analysis of the demand for network infrastructure solutions – hardware, software, and services – in the telecoms as of mid-2024. It doesn’t make cheerful reading. MTN’s aim is to look at where spending might grow, the dynamics of vendors’ market share, and the strategies vendors should pursue in the current environment.

The vendors are trying to navigate their way through a landscape in turmoil. Last year vendors’ revenues for telco network infrastructure declined by 9.2% annually to $211.8 billion (€195.77 billion), marking the steepest drop at least since 2014.

MTN states this downturn reflects the completion of 5G buildouts in major markets like the US, China, and parts of Europe, after a period of intense investment. As telcos scale back spending amid economic slowdowns and high interest rates, they face capital constraints, intensifying the pressures on vendors

Geopolitical tensions are disrupting supply chains and market access, prompting telcos to reevaluate relationships with vendors and ensure alignment with national security.

Cloudy conditions

The continuing rise of web-scale cloud providers – Amazon Web Services, Google Cloud Platform and Azure – is transforming telecoms’ infrastructure through cloud migration, AI integration and advancing automation. The shifts pose both competitive threats and partnership opportunities for traditional vendors, according to MTN.

Cloud providers are also reshaping the vendors’ landscape by offering specialised cloud-based solutions for telecoms, although with modest market gains in the market so far. [Editor’s note: Microsoft has reduced its Azure for Operators efforts to chase the bigger opportunities in the AI market.]

Huawei toughs it out

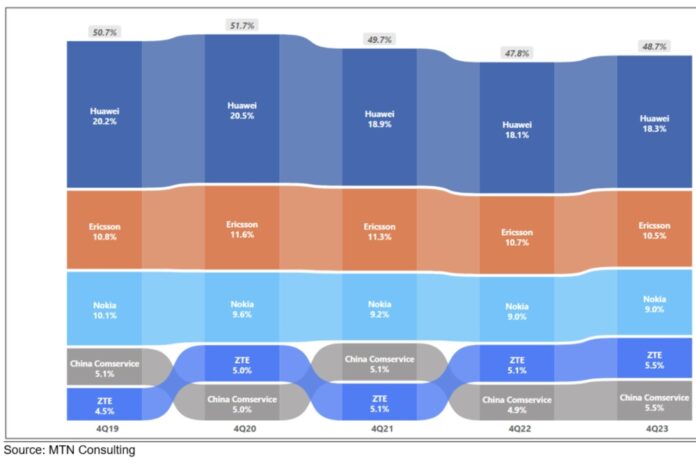

Interestingly, despite the bans on Chinese equipment in many Western and other markets, the top three vendors for network infrastructure remain the same – see schematic above.

Huawei, Ericsson, and Nokia have an aggregate market share totalling just under 38%, unchanged since 2022. This apparent stability disguises what MTN calls “significant market shifts”, sparked by the downturn in telco spending. They include consolidation among vendors, such as Broadcom’s acquisition of VMware, HPE acquiring Juniper and Nokia buying Infinera.

There is also a wave of operational restructuring underway and widespread lay-offs across the industry.

Open RAN – slow progress

Another notable shift is the push for the adoption of Open RAN by established vendors and telcos who are increasingly embracing open architectures, supported by substantial government investments.

Developments such as AT&T’s partnership with Ericsson and Deutsche Telekom’s collaboration with Nokia reflect growing momentum towards open, interoperable networks, albeit with integration challenges and slower-than-expected take up among brownfield operators.

Better in 2025?

Looking ahead, the vendor market faces a mixed outlook for 2024, with projected telco capex declining and ongoing economic pressures likely to dampen revenue prospects in the first half.

Regional developments in North America and Europe offer the potential for pockets of growth, driven by the expansion of broadband and regulatory shifts favouring non-Chinese vendors.

Even so, these development might not offset the first-half setbacks, but “substantial gains are projected [by MTN] from 2025 onward, indicating that although 2024 is likely to decline, it won’t be as severe as the year-on-year drop of 9.2% drop in 2023.