Mobile payments made using Near Field Communications (NFC) will only take off if consumers get used to using it for other value-added services, and telcos make it work before the likes of Apple find a better way, says Miles Quitmann, managing director at NFC vendor Proxama.

What is slowing the market down, says Quitmann, is that there are too many organisations trying to do m-payments.

He told Mobile Europe: “Absolutely, they should be working on mobile payment capabilities, but they’re missing a trick by not engaging consumers today with magical experiences.”

Ultimately, he says loyalty, QR codes and geo-fencing will lead to consumers using m-payments.

One telco that is doing it right is WEVE – the O2, EE and Vodafone JV aims to offer a large-scale m-commerce platform to retailers, advertisers and banks with the three operators’ combined opt-in subscriber base of 70 million customers.

“WEVE is taking the right approach, by launching those joined-up capabilities but understanding that payments is quite difficult, and that there are lots of ecosystem players that need to get involved. You need to do loyalty and marketing first because that’s how you get consumers involved,” says Quitmann.

The JV launched in 2012 and CTO Justin Tomlinson told Mobile Europe earlier this year that it is rolling out its technology in stages – so far, it has focused on SMS and MMS campaigns (Read Mobile Advertising: A tough nut to crack).

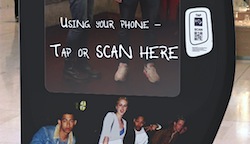

In order to get consumers involved, NFC needs to be everywhere. Global outdoor advertising vendor CBS Outdoors is keen to expand its reach and recently signed a deal with Proxama to become its international NFC technology partner.

Using Proxama’s cloud-based campaign and voucher management platform “TapPoint”, CBS Outdoors intends to enable 5,000 media assets on the London Underground and 2,000 assets on UK National Rail with NFC by the end of 2014 (Read Three launches NFC marketing campaign in Stockholm subway carriage).

The platform can be used to deliver voucher collection and redemption, loyalty cards, video and audio downloads, product information and app downloads, put together with an NFC tag antenna which can be embedded virtually anywhere, from bar tap handles, charity collection tins and posters to digital advertising panels in tube stations.

For example, if a user were to tap a Guinness bar tap with an NFC-enabled smartphone, the dual-link in the NFC tag would launch either a mobile browser with a hyperlink to a Guinness landing page, or the Guinness app if it has been installed on the user’s smartphone.

The hyperlink in the NFC tag connects to the server of the TapPoint platform, which makes intelligent decisions about what content to show users and changes the content the user sees each time they tap the NFC tag, for example a money-off coupon, a video commercial or a game about a company’s brand or products.

“We’re working very closely with the GSMA and WEVE to build the standards for contactless redemption of loyalty coupons. Network operators in Europe are all building out the ecosystem for NFC and payments. NFC payments is important to them, but they know it takes time,” said Quitmann.

“I have no doubt this will happen though because the infrastructure for contactless payments is increasing – there are more and more NFC-enabled terminals now.”

Paul Crutchley, the GSMA’s Strategic Engagement Director, echoed this point in an interview with Mobile Europe earlier this year: “While there are other technologies available across the retail market, NFC is currently the most widely available,” he said.

Quitmann points to the problems with one such alternative – Bluetooth. “How many Bluetooth low energy terminals are there in retailers? A big fat zero,” he says.

He doubts that Bluetooth low energy payments will ever take-off as consumers prefer to have a point-of-sale terminal where they can make a transaction in a store.

But NFC proponents need to find a better way to brand NFC before Apple finds a better way to do so, he adds.

“The problem with NFC is that it doesn’t sound very nice. But one day Apple will come along, launch another iPhone with ‘iTap’ [for example], and suddenly everyone will be using NFC because Apple is good at making great user experiences. The industry needs to wake up and steal a march on the iPhone before it’s too late,” he explains.

Mobile Europe’s fourth annual industry survey is now live. Click here to take part.