2G areas will receive “high-performance” 4G/5G coverage but questions remain as to when the operator commits to mid-band 5G investment

Deutsche Telekom (DT) announced it will be switching if its venerable 2G network in the Summer of 2028, around three decades after it was first introduced. The operator will use the spectrum currently blocked by 2G in the frequency range around 900MHz for the “much more powerful technologies in the future”.

According to Telekom Deutschland CTO Abdu Mudesir areas that have so far only been covered by 2G, but not by 4G, will receive 4G/5G coverage as part of the ongoing network modernisation even before the 2G network is switched off. In addition to the old 2G frequencies, other frequency ranges will also be used, making data transmission finally usable in areas where only phone calls were previously possible via 2G. After the 2G shutdown, the freed-up frequencies in the 900 MHz band will be additionally used for new technologies, leading to another performance boost.

The operator points out that mobile phones without 4G (LTE) are rare today. Although, as Australia is finding out right now, as it switches off its 3G networks, quirks like having 4G handsets using 3G for emergency services calls are enough to delay entire network shutdowns.

DT is aware it can’t slip up on handset replacements warning that “when purchasing or regularly replacing devices and services, it will be important to ensure support for modern technologies such as 4G/LTE and 5G, or for IoT applications, Narrowband-IoT (NB-IoT) and LTE-M. For phone calls, the Telekom Voice-over-LTE standard (VoLTE) or 5G VoNR (5G Voice-over-New-Radio) must also be supported.”

Telekom said its 3G retirement will be completed by end of 2024 in all European operating countries. It added it has the overall potential of 44,200+ 2G sites to retire across its EU footprint.

“With the 2G frequency spectrum that will be freed up, we can further improve our network,” said Mudesir. “We want fast data transmission for everyone – and we want it everywhere. That’s why we will use the frequencies in our network for 4G and 5G in the future to make mobile surfing even better, especially in rural areas.”

Mid-band mystery

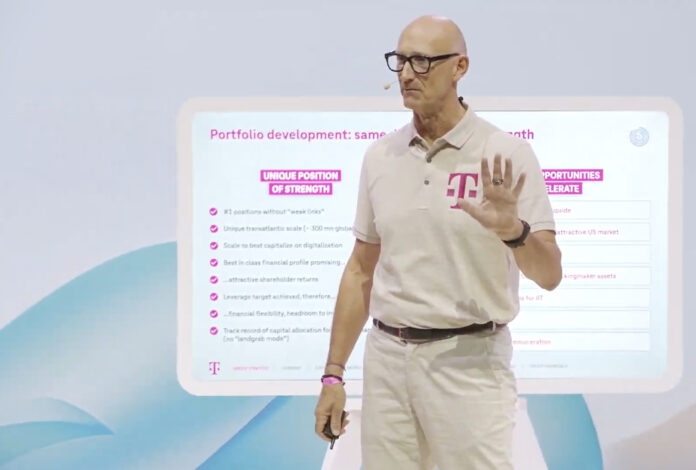

At the operator’s capital markets day (CMD), CEO Tim Höttges (above) was bullish about the telco’s plans for 5G. DT’s 5G coverage in Germany is expected to rise to around 99% by 2027. The plan is for around 90% of the sites to have download speeds of more than 1Gbps.

5G coverage in its other European national companies is set to rise from 78% currently to 95% in 2027. DT “wants to further expand its leading position as the world’s number one in terms of mobile network quality and transmission speed. It plans to grow its revenues by further increasing market shares and through a portfolio including fixed-network substitution, 5G campus solutions, and network slicing.”

However, in the prepared materials mid-band investment remains a conundrum as it revealed that only 7% of DT’s sites across Europe support 3.5GHz and this may only hit 20% or so by 2027. The numbers reveal two things. The first is that the operator’s increased capital intensity is heading towards fibre spend but also, that sub-2GHz is more attractive to DT in its 5G plans.

And the lack of commitment to 3.5GHz sort of contradicts the operator’s own position on mid-band. Responding to an EC paper in June, DT laid out what is wants from spectrum policy: “Promoting swift availability of spectrum by unconditionally supporting the full utilisation of the existing 5G Pioneer 3.5 GHz-Band for public mobile networks without any set-asides, the rapid and Europe-wide harmonised availability of the upper 6 GHz band as a foreseeable key band for 6G, and a clear commitment for the designation of the UHF-band for 6G area coverage from 2030 onwards.”

Operators rolling out 3.5GHz 5G Standalone have the potential for higher long-term profitability due to the ability to offer advanced services and unlock new revenue streams in industries requiring low-latency, high-capacity networks. However, the high initial costs of deploying SA networks may slow down profitability in the short term. This may explain the reticence to go full on with 3.5GHz given that operators using mixed frequencies and non-Standalone enjoy short-term profitability due to lower capex and the ability to deploy 5G quickly.

Needless to say, Deutsche Telekom’s reliance on Huawei 5G kit is influencing its strategy here as sweating its current assets creates less pain than ramping up metropolitan 5G capex to accommodate widespread 3.5GHz.