A comprehensive report by SNS Telecom & IT about the global market explores private networks’ enormous variety and their advantages

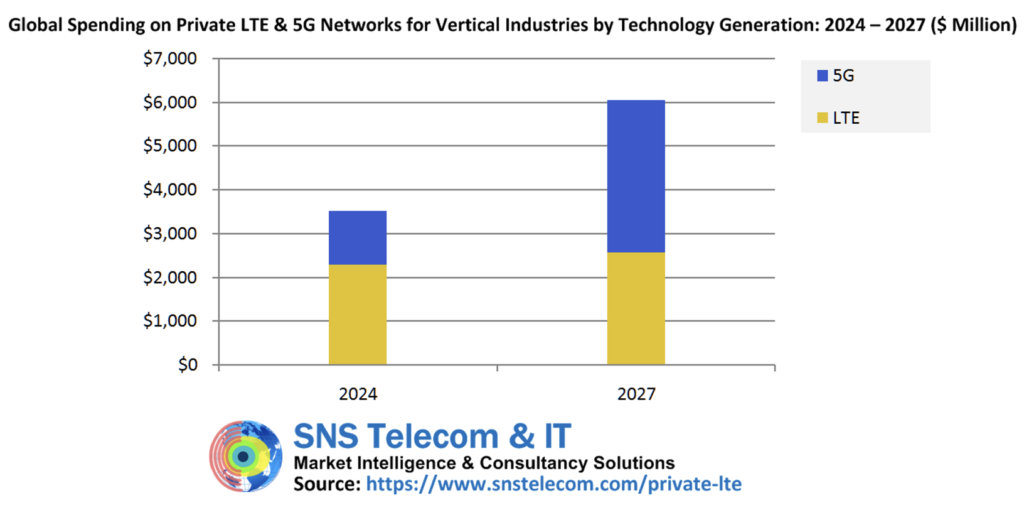

A new report by SNS Telecom & IT predicts the private LTE and 5G network market will be worth $6 billion by the end of 2027. The report estimates that global spending on private LTE and 5G network infrastructure for vertical industries will grow at a CAGR of about 20% between 2024 and 2027, accounting for more than $6 billion (€5.533 billion) by the end of 2027.

This unprecedented level of growth is likely to transform private LTE and 5G networks into an equipment ecosystem that is almost equal to public mobile operator infrastructure by market size by the late 2020s. By 2030, private networks could account for as much as a fifth of all mobile network infrastructure spending.

5G Core infrastructure for standalone 5G connectivity services has been deployed by less than a tenth of the world’s 800 or so public mobile operators. It is making much faster progress in the relatively smaller but burgeoning private cellular segment where its performance and system efficiency advantages compared to non-standalone 5G networks are more easily consumable in the short term.

Almost 60% of NPN investments, about $3.5 billion, to the end of 2027 will the building of standalone, private 5G networks. Eventually this will become the predominant wireless communications tech to support Industry 4.0 revolution for the digitalisation and automation of manufacturing and process industries.

The report examines the current situation and potential for NPNs in agriculture, aviation, broadcasting, construction, education, forestry, healthcare, manufacturing, military, mining, oil & gas, ports and maritime transport, public safety, railways, utilities and warehousing, among other smaller verticals.

The report says that although this is regarded as a niche segment, referred to as non-public networks (NPNs) by 3GPP, these networks have rapidly gained popularity due to their advantages regarding privacy, security, reliability and performance over public mobile networks and competing wireless technologies.

End-user organisations have credited private cellular network installations with productivity and efficiency gains for specific manufacturing, quality control and intra-logistics processes in the range of 20 to 90%, cost savings as high as 40% and an uplift of up to 80% in worker safety and accident reduction.

SNS Telecom & IT reckons they have the potential to replace hardwired connections with non-obstructive wireless links. Previously these sectors have been dominated by Land Mobile Radio (LMR), Wi-Fi, industrial Ethernet, fibre and other disparate networks.

NPNs have gained recognition as an all-inclusive connectivity platform for critical communications, Industry 4.0 and enterprise transformation-related applications. The 3GPP has led the standardisation of features such as: Mission-Critical PTT, Video & Data (MCX); Ultra-Reliable, Low-Latency Communications (URLLC); time-sensitive communications; Reduced Capability (RedCap) for Industrial IoT); Non-Terrestrial Network (NTN) connectivity; Standalone NPNs (SNPNs); Public Network-Integrated NPNs (PNI-NPNs) and network slicing.

Liberalisation of spectrum is also accelerating the adoption of private LTE and 5G networks as a number of national regulators worldwide have released or are in the process of granting access to shared and local area licensed spectrum.

Examples in Europe include:

• the availability in Germany of 3.7-3.8 GHz and 28 GHz licences for 5G campus networks;

• the shared and local access licensing model in the UK;

• Ireland’s planned licensing regime for local area Wireless Broadband systems; • France’s vertical spectrum and sub-letting arrangements,

• Spain’s reservation of the 26GHz band for self-provisioned local networks,

• Netherlands’ 3.5 GHz licences for plot-based networks,

• Switzerland’s NPN spectrum assignment in the 3.4-3.5 GHz band,

• Finland’s 2.3 GHz and 26 GHz licenses for local 4G/5G networks,

• Sweden’s 3.7 GHz and 26 GHz permits,

• Norway’s regulation of local networks in the 3.8-4.2 GHz band,

• Poland’s spectrum assignment for local government units and enterprises.

In the Middle East, Bahrain offers private 5G network licences.

What is a private mobile network?

Equipment suppliers, system integrators, private network specialists, mobile operators and other ecosystem players have slightly different perceptions as to what exactly constitutes a private cellular network. SNS Telecom & IT says that LTE and 5G-based private cellular networks come in many shapes and sizes:

• isolated end-to-end NPNs in industrial and enterprise settings

• local RAN equipment for targeted cellular coverage

• dedicated on-premise core network functions

• virtual sliced private networks,

• secure MVNO platforms for critical communications and

• wide area networks for application scenarios such as PPDR (Public Protection & Disaster Relief) broadband, smart utility grids, railway communications and A2G (Air-to-Ground) connectivity.

There is a consensus that private LTE and 5G networks refer to purpose-built cellular communications systems intended for the exclusive use of vertical industries and enterprises, some parties extend this definition to include other market segments. For example, 3GPP-based community and residential broadband networks deployed by non-traditional service providers. Another closely related segment is neutral host infrastructure for shared or multi-operator coverage enhancement in indoor environments or underserved outdoor areas.

Despite the somewhat differing views on market definition, one thing is clear – private LTE and 5G networks are continuing their upward trajectory with deployments targeting a multitude of use cases across various industries. They comprise localised wireless systems for dedicated connectivity in factories, warehouses, mines, power plants, substations, offshore wind farms, oil and gas facilities, construction sites, maritime ports, airports, hospitals, stadia, office buildings and university campuses.

They also cover regional and nationwide sub-1 GHz private wireless broadband networks for utilities, networks that are ready for Future Railway Mobile Communication System (FRMCS), that is, train-to-ground communications and hybrid government-commercial public safety LTE networks.

Custom-built cellular networks have also been implemented in locations as remote as Antarctica, and there are even plans for installations on the moon’s surface and outer space.