At its Capital Markets Day on 10 October, CEO says DT Group now worth more than its European rivals put together and is looking to AI to accelerate growth

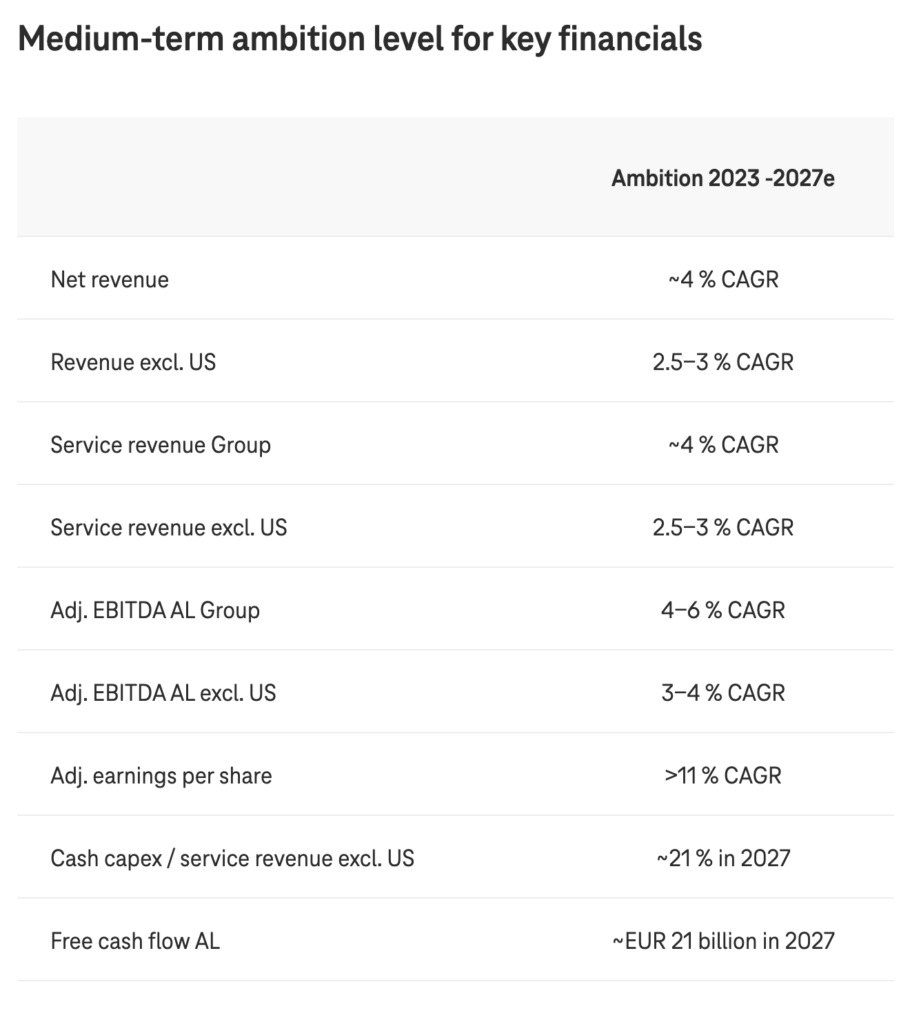

Tim Höttges, CEO of Deutsche Telekom Group (pictured above) kicked off the operator’s Capital Markets Day in Bonn explaining how a “refined strategy” will introduce new phase of growth. The group is looking to AI, a data-driven business model and global economies of scale to accelerate its “reliable growth model”. The aim to increase net revenue and service revenues by an average of 4% annually to 2027.

He said the group was “in a much better position than we have ever been in our history”. He was even chipper about DT’s stake in BT, where he thinks perhaps there will be light at the end of the tunnel.

Adjusted EBITDA AL* is set to grow by an average of 4 to 6% per year. Although, according to Höttges, growth will come from the businesses on both sides of the Atlantic, excluding T-Mobile US, DT Group expects service revenues to grow by an average of 2.5 to 3% annually, and adjusted EBITDA AL* by between 3 and 4%.

At the same time, adjusted earnings per share are expected to rise by an average of more than 11% per year, reaching around €2.50 in 2027. Free cash flow AL is expected to increase to around €21 billion by that time.

Buy-backs, bigger stake in T-Mobile US

CFO Ilke said in his presentation at the press conference that “surplus funds” would also be used to increase DT’s stake in T-Mobile US. Shareholder remuneration, including share buy-backs will total up to €6.4 billion: share buy-backs amounting to up to €2 billion are set to be carried out in 2025. Dividend for the 2024 financial year to rise to 90 cents per share.

Deutsche Telekom finally surpassed a 50% stake in T-Mobile US in April 2023, after years of increasing ownership in the American company. DT’s stake in T-Mobile US was diluted to 43% when it merged with Sprint in 2020. As Sprint’s owner, SoftBank, took 24% of the combined entity.

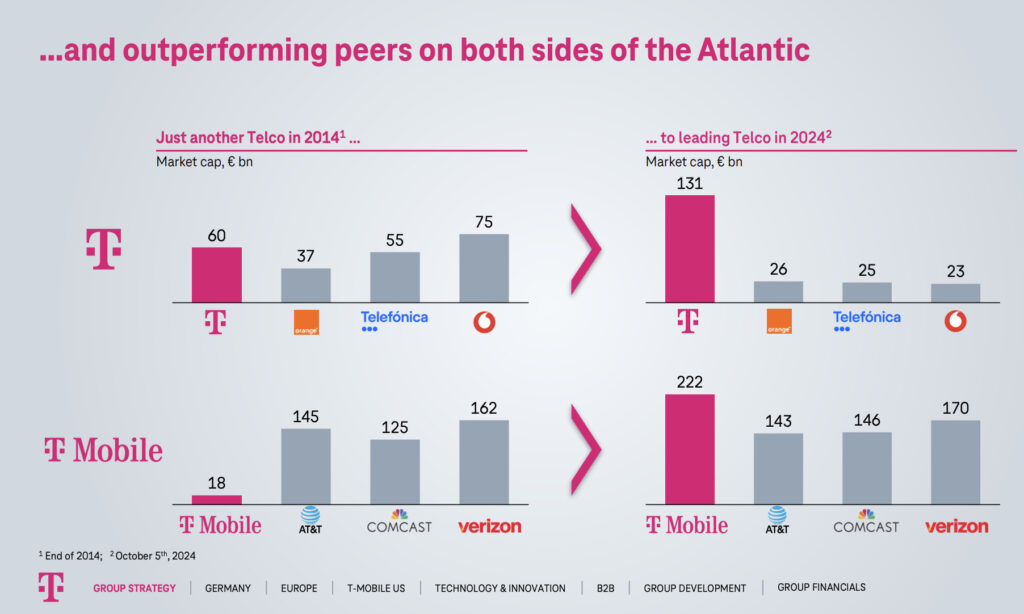

“We are initiating the next stage,” said Höttges. “In recent years, our strategy has made us the undisputed number one in Europe. We have achieved or even exceeded nearly all of our targets and are now worth more than all our peers on our domestic continent combined [see slide below from today’s press conference]. We will build on this position in the future, for example, by further intensifying the use of artificial intelligence.”

The value of DT’s brand has risen 84% since 2020. Brand Finance reckons Deutsche Telekom is the industry’s most valuable brand worldwide, and across all industries, the Magenta T symbol tops the table in Europe and ranks number nine globally.

By 2027, DT plans to generate a total of more than €15 billion, on top of the investments in the business and the dividend payments. This leeway will give the operator group the flexibility to either increase its stake in T-Mobile US, or to buy back additional shares as well as facilitate general strategic flexibility.

Investments of the Group, excluding the US and expenses for mobile spectrum in Europe are expected to account for around 21% of service revenues in 2027.

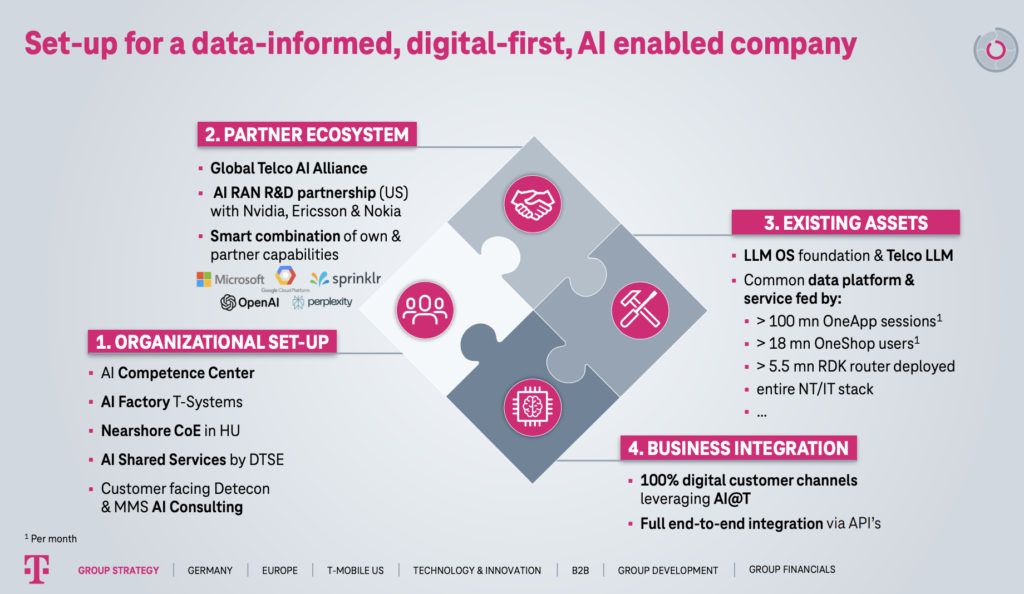

Growth is to be driven by improving the business model. DT wants to be “even more data-driven and automated than before and step up its use of AI – see slide below for how it expects to achieve it. This includes simplified customer support processes that are “better channelled” and accelerated through automated ID, and documentation and AI-based information requests.

In Germany, the number of complaints has already fallen by around two thirds since 2020. The plan is to reduce call volumes further by expanding the use of app-based self-service and AI-supported messenger services. “The Group plans to continue to rigorously pursue digitalization and its focus on software.”

The Group wants better global economies of scale. It has about 300 million customers worldwide and wants to leverage globally-available services and API-based IT platforms in the cloud with the help of global ICT solutions and partnerships.

Building out fibre

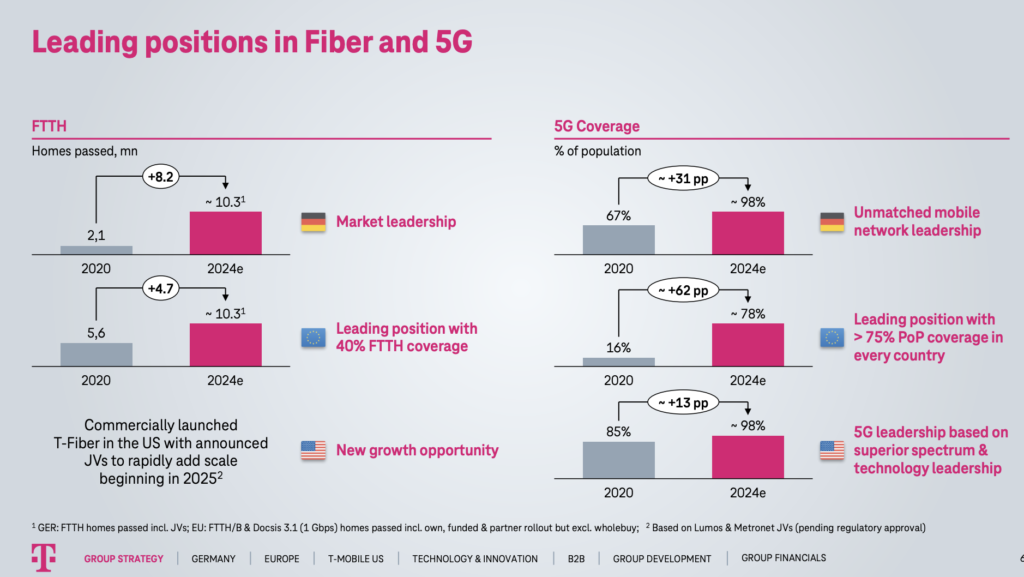

DT continues to invest “massively” in building out fibre broadband, having come to that party late. In Germany, it intends to add about 2.5 million new homes passed per year by 2027, taking the total number passed to about 17.5 million. noted that many investors are “running away from the German market…we are building more than 70% of the infrastructure now”. He added, “Germany is lagging behind in fibre but leads in terms of throughput”.

The operator expects the take-up rate to increase by almost a third, to more than 20%, up from 14% today. In 2027, the number of new FTTH customers is expected to reach around one million, up from an anticipated 450,000 this year.

Its other European opcos are expected to add around 1 million homes passed per year. In 2027, the total number of homes passed in those countries expected to stand at a total of around 13.5 million.

Regarding its mobile network, DT’s 5G coverage in Germany is expected to rise to around 99% by 2027. The plan is for around 90% of the sites to have download speeds of more than 1Gbps.

5G coverage in its other European national companies is set to rise from 78% currently to 95% in 2027. DT “wants to further expand its leading position as the world’s number one in terms of mobile network quality and transmission speed. It plans to grow its revenues by further increasing market shares and through a portfolio including fixed-network substitution, 5G campus solutions, and network slicing.”

The operator group intends to boost its Magenta Moments loyalty programme in Germany and other European countries, which had about 3.2 million active users as of the end of 2023. It expects this figure to grow by between 50 and 100% by 2027. The Group wants to tap into additional revenue potential of around €1.5 billion with additional products and services. They range from payment services for mobile phone insurance services and platforms for payment services to AI solutions for consumers.

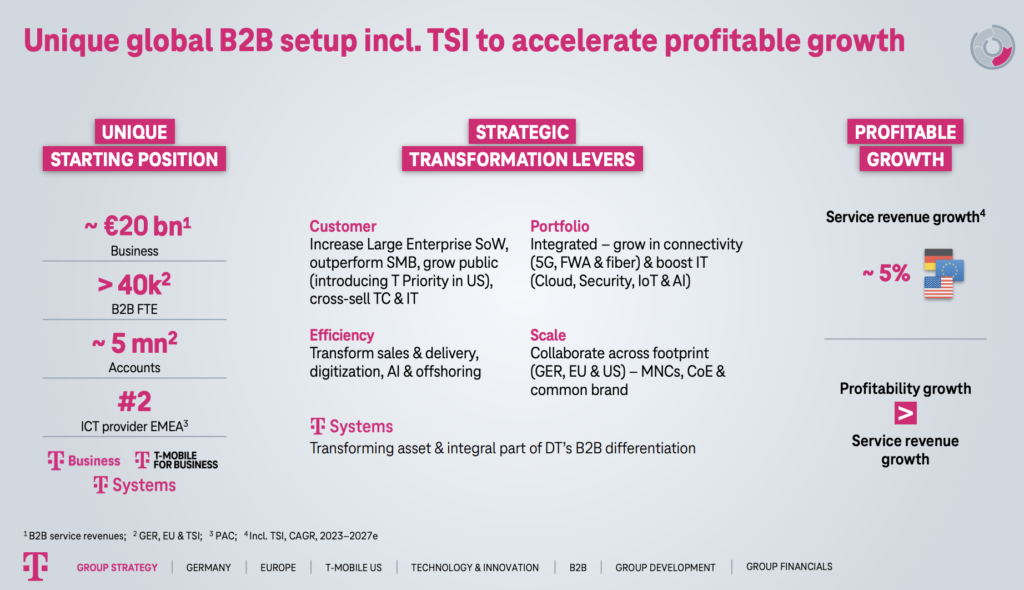

Doing the business

In global B2B business, that is, with business customers including T-Systems, DT plans to speed development of revenue and earnings. This is one of the group’s weakest areas historically, with average revenue growth of 1.9% between 2020 and 2024. Now it says growth in this area is expected to rise to 3%, with a commensurate increase in profitability.

Somewhat stating the obvious, DT says this will be achieved by increasing its share of contracts awarded by corporate customers, stronger growth in the public sector and cross-selling. The expansion of the portfolio in the areas of cloud, security, IoT, and AI. T-Systems is an integral component, contributing to differentiation from the competition for customers, DT says.

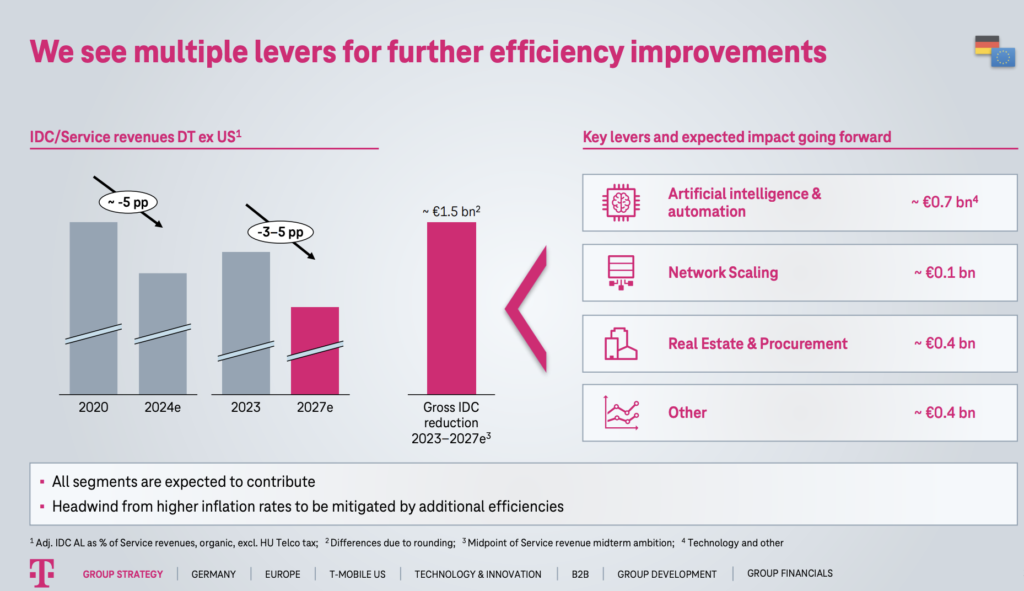

Plenty of efficiency levers

Efficiency improvements at all levels will support earnings growth over the next few years. The relevant metric for this is indirect costs as a percentage of service revenue, for the Group excluding the US. DT wants to reduce this figure by 3 to 5% by 2027.

The main levers for this (see slide below) are automation, including the use of AI in customer service, automation in the operation of networks and data centres, improved efficiency in the FTTH rollout in Germany, implementation of a shared operating model in Europe and reduction of shared functions, and efficiency improvements through the use of AI. This particularly applies to expenses for real estate and its use.

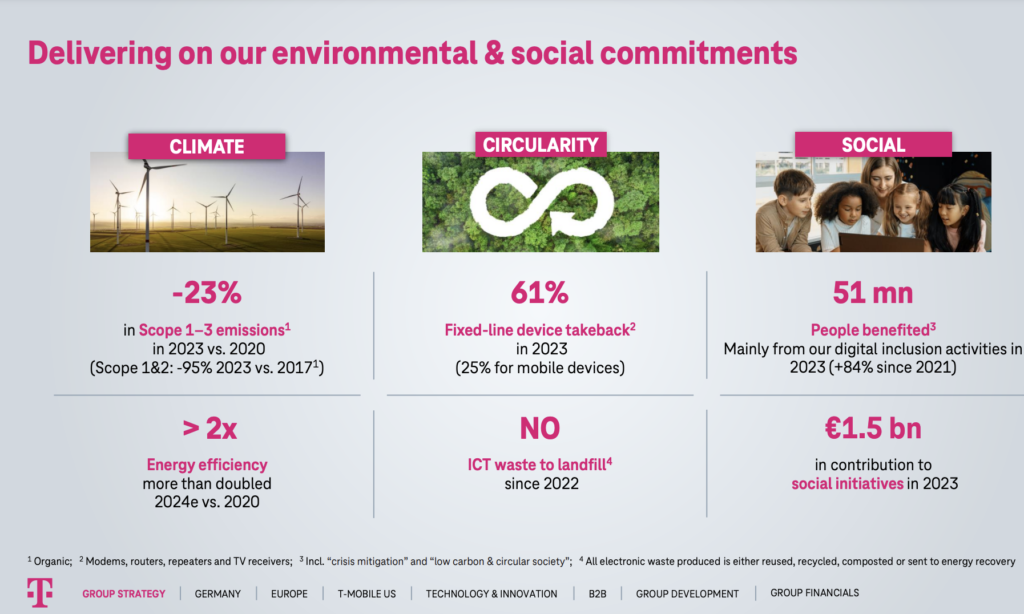

Environmental, social, governance

The Group says its has “ambitious targets with regard to ESG activities. Carbon emissions (Scope 1-3) are set to fall by 55% by 2030 compared with 2020, and to reach net zero across the entire value chain by 2040. Deutsche Telekom claims to be “the first DAX 40 heavyweight with a science-based net-zero climate goal confirmed by the Science Based Targets initiative (SBTi). In its transition plan, the Group has stipulated specific measures for this.”

The measures include a circular market for terminal equipment and technology, through longer useful lives as well as reuse and the recycling of materials. The Group is to expand its commitment to digital inclusion such that, by the end of 2027, more than 80 million people worldwide will benefit from the measures.

*“EBITDA corresponds to EBIT (profit/loss from operations) before depreciation, amortization and impairment losses. EBITDA AL is calculated by adjusting EBITDA for depreciation of the right-of-use assets and for interest expenses on recognized lease liabilities,” according to DT’s website