Analysts Tefficient find that fewer operators globally have been able to turn rising data usage into ARPU increases

In 2023, 93% of operators experienced growth in data usage per subscription, with 71% of them successfully converting this into higher ARPU. This trend continued into the first half of 2024, where 95% of operators saw increased data usage, and 69% managed to translate this rise into ARPU growth.

The figures were revealed in public analysis of 123 operators’ mobile data trends by analyst house Tefficient. Compared to last year’s analysis, a lower proportion of operators were able to turn rising data usage into ARPU increases, indicating a reduced ability to leverage pricing power.

Two thirds of operators now above 10GB per subscription per month. Tefficient reports that Zain Kuwait’s impressive 68.1GB per average SIM per month comfortably grants it the number one position of the world again. Zain launched 5G in June 2019 and claimed 100% population coverage by end of 2021. The high usage comes from Zain selling smartphone plans with large buckets – with unlimited as the ultimate tier. But Zain is also offering 5G fixed routers with 2TB or, if that’s not sufficient, unlimited data volume. Zain Kuwait had 13% usage growth (+8GB per month) in 2023.

Zain Saudi Arabia is second at 57.3GB per average SIM per month in 2023. Zain launched 5G in October 2019 and did earlier this year decide on an investment plan that would double the number of cities covered with 5G, adding 7,000 sites to cover 66% of the populated area with 5G. Like Zain Kuwait, the high usage comes from Zain selling smartphone plans with large buckets – with unlimited as the ultimate tier. Zain is also offering speed-tiered 5G home plans with unlimited data volume, whose popularity might explain some of the 26% usage growth (+11.7GB per month) Zain Saudi Arabia had in 2023.

With 55.4GB per month for the first half of 2024 (51.1GB per month in 2023), DNA from Finland finished third in Tefficient’s report. Unlimited, speed-tiered, plans – both for smartphones and data-only – form a key component of the Finnish market logic. DNA doesn’t report how large share of its customer base that has unlimited plans, but for Finland as a whole, that share was 86% of non-M2M subscriptions in December 2023. The Finnish operators all launched 5G in 2019 and DNA said that it had almost 98% 5G population coverage in June 2024.

“The data usage of DNA’s corporate Subscriptions has increased by over 25 percent compared to last year. Mobile data is increasingly becoming a more common and certainly Safer option than open Wi-Fi networks, both in Finland and abroad,” said Mari Eklund (above), VP of communication solutions for DNA’s corporate business. DNA sponsored the Tefficient report.

Nordics and Baltics best

In Europe, the number 3, 4, and 5 of the world, DNA, Elisa (both from Finland) and 3 Austria, form the European podium. LMT from Latvia is ranked as number four. Iceland’s Nova is number five. 3 Denmark is number six followed by Telia Lithuania. Telia Finland is number eight. Since Telia itself doesn’t report its mobile data traffic, Tefficient assigned the Finnish country residual to Telia (after having deducted Elisa’s and DNA’s reported traffic). Bite Lithuania and Telia Denmark finish the European top ten.

The bottom five operators are from the low usage markets of Germany (Telekom incl. M2M, Vodafone), Portugal (MEO, NOS) and the Netherlands (KPN). Highest growth in Europe went to Telia Lithuania in the twelve months to June 20245 (+9.9GB) and Telia Denmark in 2023 (+9.1GB). However, if done as a percent for growth, Vodafone Greece saw 54% in the twelve months to June 2024 and 58% in 2023.

At the other end, it was Vodafone UK that had the slowest absolute growth in the twelve months to June 2024, +0.2GB (+2%). BT UK (based on its reported postpaid B2C) had the slowest growth in percent, +1%. In 2023, Telenor Denmark experienced a decline in the average mobile data usage per subscription with 6% (-1.2GB) according to regulatory data.

Traffic growth

Tefficient also measures total data traffic which is skewed by the big-population countries – China Mobile surpassed 1 billion mobile subscribers in June 2024 (of which 51% are on its huge 5G network consisting of 2.29 million base stations) – and these take up the traffic top spots. In fact the highest ranked European operator is just number 24 in the global rankings.

Italy’s Wind 3 is no longer reporting but based on Tefficient’s calculation, it is the number one in Europe. Italy has experienced an explosion in mobile data usage ever since the new fourth operator, Iliad, launched 30GB for 5.99 EUR in May 2018 – which all of competition copied. Vodafone Italy is ranked number three, Iliad is ranked number six and TIM number eleven.

The new number two in Europe is O2 Germany. Europe’s largest operator in number of mobile subscriptions had 36% traffic growth in 2023 and 24% in the twelve months to June 2024 – on par with Vodafone Germany (ranked 12th) but significantly faster than Telekom’s 12% in 2023 (ranked 9th). French operator Bouygues is number four while its competitor Free is number eight. Orange, SFR and Free could have been high ranked as well but aren’t reporting data traffic or usage. Play from Poland is number five. Based on its reported usage per B2C postpaid customer, BT ranks as number seven. The top ten ends with 3 UK.

Based on its reported usage per B2C postpaid customer for Q1 2024, BT had the slowest traffic growth of all reporting European operators in the twelve months to June 2024 – a decline of 1%. If looking at the trend in 2023, it’s instead Telenor Denmark that, according to the regulatory data, had the worst data traffic development, -5%.

Who is making money?

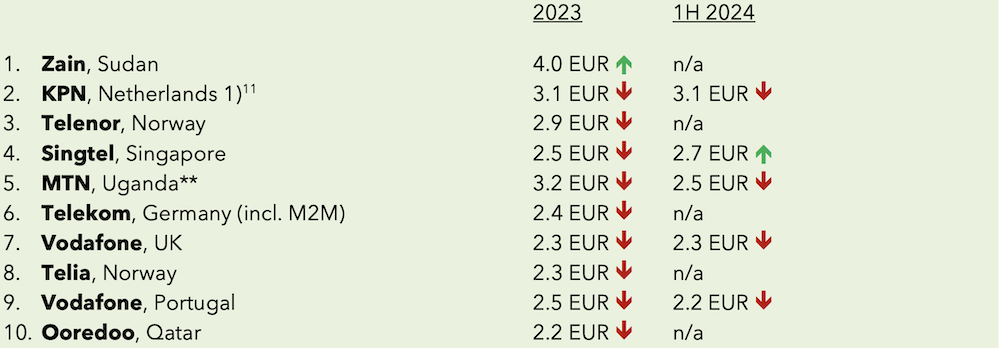

Mature markets make voice and messaging allowances unlimited and included them in a flat fee. Maturing markets still rely on usage-based voice and messaging. Despite the latter suggesting more revenue, Tefficient did not find this to Bev the case. Mixed with operators from Sudan and Uganda are European and Asian operators with equally high revenue per GB: KPN, Telenor and Telia Norway, Singtel, Telekom and Vodafone UK.

In 2023 was 36x difference between the operator with the highest total service revenue per gigabyte (KPN Netherlands) and the operator with the lowest (Jio India). In the first half of 2024, the multiplier was 41x. These multipliers are essentially unchanged compared to last year’s analysis.

Dutch, Norwegian, German, UK, and Portuguese operators play in the bottom of the Tefficient’s global graph – where the total service revenue per consumed gigabyte is high. In the other end of the scale – where the revenue per gigabyte is low – it found operators from Latvia, Poland, Lithuania, Ukraine, Finland, Italy, and Austria. Four European operators had higher revenue per GB in 1H 2024 than in 2023: Vodafone Ziggo from the Netherlands, BT, 3 UK and 3 Austria.

The analysts combined revenue per GB with usage and found that the operators with the highest revenue per GB in 2023 are Zain Sudan, MTN Uganda, KPN and Telenor Norway. The operators with the lowest revenue per GB are Jio, MTN Irancell, Airtel India, Indosat, Vi, AIS and XL. The operator with the highest usage is Zain Kuwait. The operator with the lowest usage is Zain Sudan.

Tefficient acknowledged that a criticism could be made for comparing the number of gigabyte with something that relates to it – the revenue per gigabyte. It therefore also compared the number of gigabyte with the revenue per subscription (ARPU). Of all the operators there are four – T-Mobile USA, Zain Kuwait, Telenor Norway and Telia Norway – that enjoy much higher ARPU than other operators. But in the case of Zain, the data consumption is also the highest in the world. T-Mobile’s customers use relatively much data, but neither Telenor nor Telia Norway’s customers are keen data users – yet the ARPU is high.

In the middle upper part overall group is a cluster of operators with very high average data usage but moderate ARPU between 13 and 25 EUR. Here the analysts found DNA and Elisa from Finland together with Drei (3) Austria, Zain Saudi Arabia, Nova from Iceland, LMT from Latvia, Ooredoo Kuwait, and Zain Bahrain. India’s Jio continues to be an outlier. Its ARPU isn’t the lowest – and it’s growing – but considering an average data usage of more than 25GB per month, Jio is still the affordability leader of the world.

Tefficient concluded that its data showed that operators with higher data usage tend to have higher ARPU. Conversely it is quite difficult to find national examples showing that operators with higher data usage enjoy higher ARPU. It’s typically the challenger operator that has the customers with the highest data usage and challenger operators tend to have lower ARPU than incumbents.