Who had restarting Three Mile Island, site of the US’s most significant nuclear meltdown and radiation leak, on their 2024 bingo card?

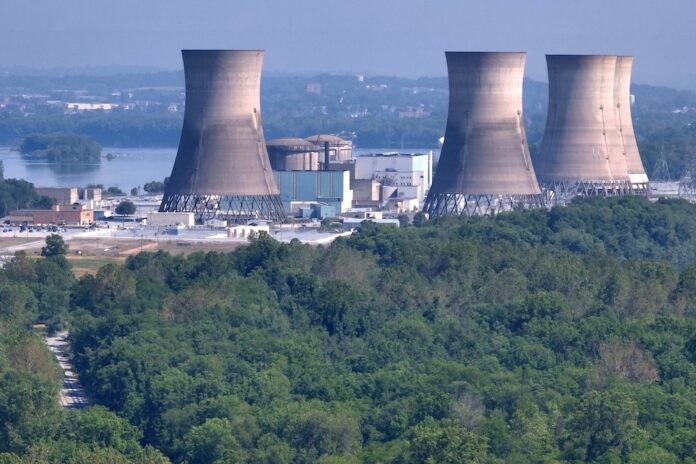

Microsoft has signed a nuclear power deal with Constellation Energy that will see Three Mile Island, the five-decades-old facility in Pennsylvania – which was shut down for economic reasons five years ago – rise from the dead to satiate the hyperscaler’s burgeoning power demand driven by AI.

This year has seen huge interest in nuclear power as the data centre industry grapples with the dichotomy between carbon goals and AI’s stupendous power consumption. Over the past six months, small modular reactors (SMRs) have been gaining traction as a solution for the increasing energy demands, particularly as AI workloads continue to grow. Companies like Last Energy are focusing on using SMRs to provide power to data centres.

These modular reactors are designed for faster and more cost-effective deployment compared to traditional nuclear plants. The US Nuclear Regulatory Commission has also approved new SMR designs, including NuScale’s reactor, which will be used to power data centres in Ohio and Pennsylvania by 2029. In April, Equinix signed a pre-agreement with Small Modular Reactor (SMR) firm Oklo to procure up to 500MW of nuclear energy. This was the first SMR deal signed by a colocation data centre company.

Microsoft’s chain reaction

Under the deal terms, Microsoft will purchase energy from the restarted plant for 20 years – and potentially set off a chain reaction of other data centre nuclear power plays. The Three Mile Island unit will provide 835 megawatts of electricity – enough to power around 700,000 homes or around 1.67 million Nvidia Blackwell GPUs, give or take. Constellation will launch the Crane Clean Energy Center (CCEC) and restart Three Mile Island Unit 1 as part of the agreement.

This reactor is adjacent to TMI Unit 2, which shut down in 1979 and is still being decommissioned by its owner, Energy Solutions. Constellation said TMI Unit 1 is a fully independent facility, and its long-term operation was not impacted by the Unit 2 accident. To prepare for the restart, significant investments will be made to restore the plant, including the turbine, generator, main power transformer and cooling and control systems.

Restarting a nuclear reactor requires US Nuclear Regulatory Commission approval following a comprehensive safety and environmental review, as well as permits from relevant state and local agencies. Additionally, through a separate request, Constellation will pursue license renewal that will extend plant operations to at least 2054. The CCEC is expected to be online in 2028.

“This agreement is a major milestone in Microsoft’s efforts to help decarbonize the grid in support of our commitment to become carbon negative. Microsoft continues to collaborate with energy providers to develop carbon-free energy sources to help meet the grid’s capacity and reliability needs,” said Microsoft VP of Energy Bobby Hollis.

Big problem

The size of investment in the facility is interesting. Reuters reports that Constellation plans to spend about $1.6 billion to revive the plant, which it expects to come online by 2028. But it demonstrates what Microsoft is up against – the AI enterprise future is a power-hungry beast.

At the recent Sydney Cloud & Datacenter Convention 2024 – one of the largest DC markets in APAC – energy company Piller Australia managing director Jonathan Davis laid out the home-truths the DC industry is coming to terms with. He said first fossil fuel currently accounts for over 60% of total global electricity generation. To be consistent with net zero emissions by 2050, that share needs to drop to 26% by 2030. The 1.5 degree scenario demands that 90% of electricity is produced in renewables by 2050.

“Hyperscale [traditionally] needed 10 to 14 kilowatts per rack in design; we’re looking at a rise to 30 to 60 kilowatts a rack,” he said. “For AI ready racks, we’ve even heard of discussions around 100-300 kilowatts a rack, which would be phenomenal If we ever get there.”

Meanwhile, he added that global energy consumption is predicted to jump from 460 terawatt hours in 2022 to more than 1000 terawatt hours in 2026.

The inevitability of nuclear?

It comes as no surprise that Nvidia’s CEO Jensen Huang is a big advocate for nuclear power being essential for sustaining AI’s explosive growth. The company’s GPUs will depend on it given conventional power generation is simply not going to cope with AI’s growth.

Alternatives exist but are not ready yet. For example, green hydrogen proponents would argue their fuel is produced using renewable energy sources and provides a flexible, zero-carbon option for energy storage and backup power. However, it still faces challenges because it is costly and currently difficult to produce. Other companies are looking at gas as a steppingstone to renewables – not carbon-free but it produces less carbon dioxide per unit of energy than coal.

Nuclear power, its proponents would argue, offers a consistent, carbon-free baseload energy source and this is a key for handling the steady and increasing power demands of data centres.

In fact, conversations in the data centre industry have shifted to facilities becoming microgrid net suppliers keeping renewable-focused grids. As energy consumption in data centres continues to surge, microgrids provide a way for data centres to achieve energy independence. By having their own self-sufficient energy infrastructure, data centres can better protect themselves from grid disruptions.

Microgrids allow data centres to optimise the power delivered to their energy-intensive processes like AI without being constrained by the main grid’s limitations or instability. It also builds a flexible energy sourcing market as it enables DCs to shift between different energy sources like solar, battery, and nuclear as market prices fluctuate.

From a supply perspective, microgrids allow data centres to integrate various renewable energy sources, such as solar, wind and nuclear, to generate their power. DCs can also become energy producers, feeding the grid. As many will have batteries, these help store excess renewable energy produced during peak hours for use when demand is high.

DC operators are also going to be arguing that nuclear power is inevitable in microgrids to reduce the burden on national or local grids, which are increasingly under pressure from growing digital demands. Microgrids, they argue, could also export excess energy back to the grid, providing a buffer during peak demand periods.

Microgrids represent a “megatrend” for data centre futures and pressure will increase on both the operators and the energy companies to review their stance on nuclear. Which way it develops may end up reflecting the politics of each country rather than the science, but one thing is for certain, “carbon-free” and “clean” are going to be used interchangeably by proponents of nuclear and become polar opposites for those against.