In hindsight, the company’s announcements at MWC signalled that the pivot to AI-over-all was already irreversible

While Microsoft’s decision to cut hundreds of jobs at its Azure cloud unit was reported widely as a general tech malaise, the focus areas of the cuts signalled a pivot in how it was approaching the telco market. According to the reports, first raised by Business Insider, Microsoft’s Azure for Operators layoffs would reportedly involve up to 1,500 jobs.

The other impact area was the mixed reality Mission Engineering team which is not too much of a surprise given the real world has triumphed over the metaverse, at least in enterprise terms. Korea Telecom is only the latest to quietly withdraw from enterprise metaverse.

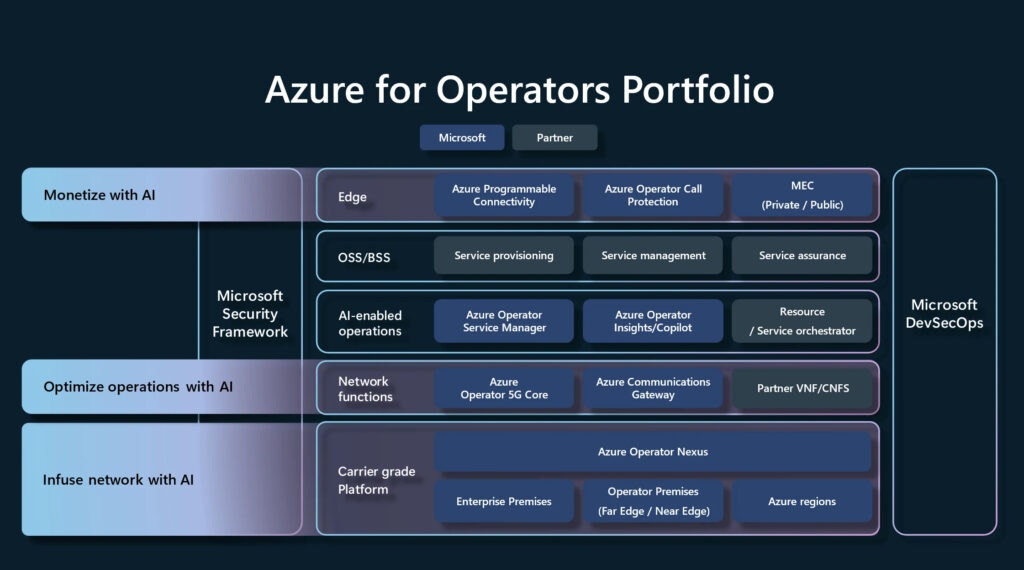

With Azure for Operators, Microsoft wanted to build an ecosystem of partners that could run AI-driven networks on a carrier-grade, hybrid cloud platform. But carrier networks are littered with legacy tech so the efforts to integrate multiple, diverse partners to apply multiple diverse back-office solutions to multi-diverse operators would always live and die by its unit sales.

Microsoft’s acquisition of Affirmed, plus AT&T moving its 5G core network into Azure, were clear milestones the cloud provider understood how to shift packet core workloads to the cloud. But while Affirmed gave it the ability to extend cloud-based software defined networking into the world of 5G connectivity, Ericsson, Nokia, Samsung and the Open RAN proponents were on the similar paths and have the incumbency.

AI-over-all

In a follow up story, Business Insider [subscription required] confirmed that Microsoft was pivoting to AI for pretty much everything – Microsoft has announced billions in data centre/AI investments globally in the past couple of months alone. Business Insider reported a leaked memo from exec Jason Zander suggesting the layoffs were a direct result of its AI investment.

The memo reportedly also confirmed Microsoft would halt previews for Azure Operator 5G Core (AO5GC) and Azure Operator Call Protection. In addition, some remaining team members in Azure Operator Nexus are heading off to Microsoft’s Azure Edge and platform product line teams. Given the fact that Azure Operator Nexus had been described by some in the industry as the new operating system for telcos, it is easy to discern the complete change in thinking around what telco OSS/BSS/orchestration and so on is going to look like.

MWC hints

The public preview of Azure Operator Call Protection, the service that uses AI to help protect consumers from scam calls, was literally only previewed at Mobile World Congress. At the time, Microsoft announced BT was trialling the service which used real-time analysis of voice content, alerting consumers who opt into the service when there is suspicious in-call activity.

E& UAE was named as a customer of Azure Operator Nexus hybrid cloud platform that enabled operators to run workloads on-premises or on Azure. AT&T was also cited although the latter moved its 5G core to Microsoft’s Cloud. Three UK was mentioned as a user of Azure Operator Insights.

Microsoft also launched Azure Programmable Connectivity (APC), which provides a unified, standard interface across operators’ networks and seamless access to Open Gateway for developers to create cloud and edge-native applications that interact with the intelligence of the network. This will presumably be wound up.

One service that will probably survive in a different form – only had a limited preview at MWC – was Microsoft’s Copilot in Azure Operator Insights which allows engineers to use Copilot to interact with network insights using natural language and receive simple explanations of what the data means and possible actions to take. That said, this is pretty similar territory to the Global Telco AI Alliance.

Too niche?

The point is that many operators are deeply embedded with Microsoft already – they are past the point of accepting that their compute workloads need to run in the cloud. And its Microsoft’s OpenAI work that operators can not only embed in their back-office processes but can potentially monetise as well. In Match, for example, Deutsche Telekom signed up its first Business GPT customer.

Telefónica evolved its digital framework for the creation of advanced services, Kernel, by adding new Microsoft Azure AI services to power every relevant use case with generative AI capabilities at scale. Meanwhile, Vodafone said it will apply Microsoft Azure OpenAI to deliver frictionless, real-time, proactive and “hyper-personalised” experiences across all Vodafone customer touchpoints, including its digital assistant TOBi (available in 13 countries).

Operators are going to continue to embed AI wherever they can get a cost benefit, regardless of whether Azure for Operators exists or not. Microsoft’s decision to cull in this area just reminds operators that sorting out their back-office IT stack is not straightforward and certainly not yet standardised. And it does not diminish the impact Microsoft will have with AI in telco environments.