Year-on-year growth barely budges in Q2 according to GSA database

According to global mobile supplier organisation (GSA) the number of telcos investing in 5G SA globally was 115 across 52 countries – the same as the previous quarter. And when compared to this time last year, has only nudged up marginally.

This equates to 21.4% of the 535 operators known to be investing in 5G licences, trials or deployments of any type and the slow down can be attributed, in part, to the telcos having to shift to a cloud-based, virtualised, microservices-based core infrastructure to get the full benefits of 5G SA.

GSA is tracking the emergence of the 5G SA system, including the availability of chipsets and devices for customers. Initially with Standalone, analysts were quick to point out the lack of devices as a key blocker on 5G SA but the evidence here is that this is no longer the case.

Instead, operators are grappling with transforming their operations and processes to get the proper benefits 5G SA is meant to deliver.

Of the 115 telcos only 36 operators in 25 countries and territories are now understood to have launched or deployed public 5G SA networks, two of which have only soft-launched their 5G SA networks. The rest are still trialling and planning commercial deployment. In fact, 19 operators have been catalogued as deploying or piloting 5G SA for public networks and 29 are listed as planning to deploy or evaluating, testing or trialling the technology.

Devices are turning up all the time

With 5G SA networks just beginning to be launched, GSA said it was aware of 1,750 announced devices with claimed support for 5G SA, up 155.1% from 686 at the end of 2021. Of those, 1,487 devices are already commercially available, up 184.8% from 522 at the end of 2021.

The number of 5G SA devices as a percentage of all 5G devices announced has also been steadily climbing. They accounted for 35.6% of 5G devices in December 2019, 49.7% in December 2020 and 54.6% in December 2021 and a large increase to 81.8% in December 2022. As of June 2023, they account for 85.8%.

Phones make up over half (59%) of the announced 5G devices with stated 5G SA support (1,034 phones), followed by fixed wireless access CPE (246) and modules (220). Looking solely at devices that are now commercially available, phones account for an even larger proportion, at 63% (938 phones), followed by fixed wireless access equipment (188 devices) and modules (160 devices).

A total of 137 vendors have commercial 5G devices for SA networks and another 65 have announced devices.

Private networks a bright spot

As of the GSA’s last update in May 2023, it had collated information about 1,148 organisations known to be deploying LTE or 5G private mobile networks or known to have been granted a licence suitable for the deployment of a private LTE or 5G network so far. Of those, 505 are known to be using 5G networks (excluding those labelled as 5G-ready) for private mobile network pilots or deployments.

Of those, 66 (just over 13%) are known to be working with 5G SA already. They include manufacturers, academic organisations, commercial research institutes, construction, communications and IT services, rail and aviation.

Chipset spectrum support but not so much for mmWave

GSA said it has identified 42 chipsets announced as supporting 5G carrier aggregation of some sort and 58 chipsets announced as supporting VoNR – both important features for encouraging widespread adoption.

Unsurprisingly, support for millimetre wave is not yet common. Chipsets are being developed to support this capability — GSA has currently only catalogued eight chipsets specifically supporting 5G SA in mmWave spectrum (eight mobile processors and platforms).

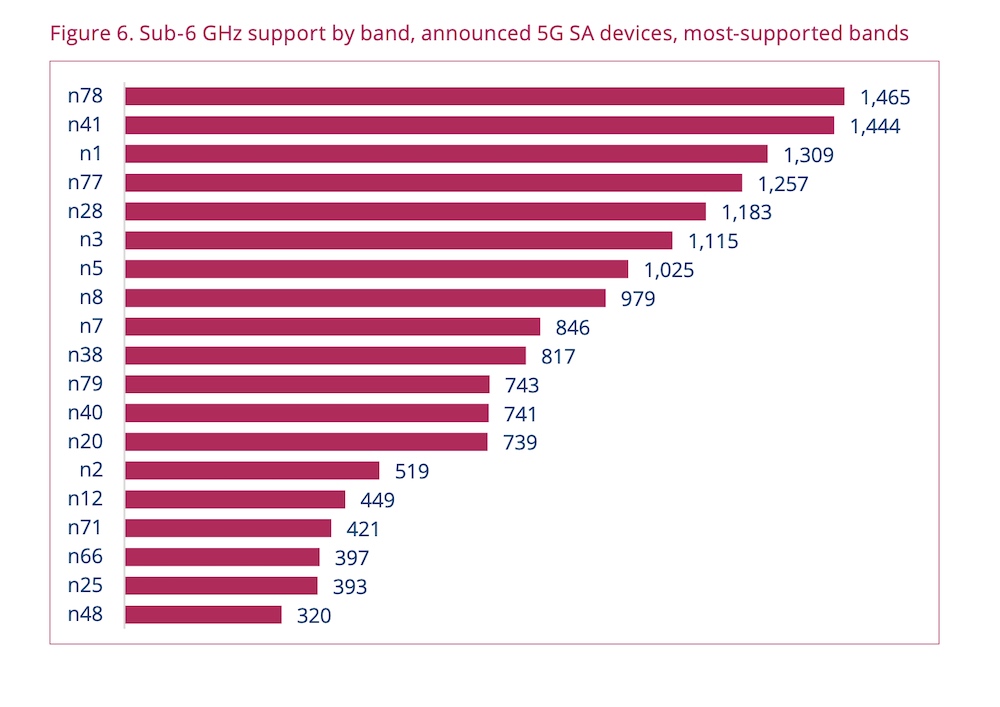

In contrast, selected sub-6 GHz frequencies are increasingly well supported in 5G SA devices. The pattern of most-supported bands in sub-6 GHz 5G SA devices largely matches the pattern for most-supported bands across all 5G devices, with C-band, 2.6GHz, 2GHz, 1.8GHz and 700MHz known to be catered for by most devices.

“We can expect support for spectrum bands above 6GHz to increase in the future, as these bands are being promoted as an option for deployment of private 5G networks by regulators in various countries, as well as being promoted as capacity bands for high-traffic locations in public networks,” concluded GSA.