Telecoms are at a crossroads – telcos are the backbone of the digital economy and have customers’ trust, yet continue to face long-standing challenges

Growth has eluded telcos despite their massive investments in 5G and full-fibre networks, with European expectations hovering at just 1-2%. High costs and suboptimal returns on capital add to the strain, while competition from other connectivity providers – tech giants, satellite companies, and others – intensifies.

Most alarmingly, customers increasingly perceive telcos as utilities, reducing their value proposition to that of “pipes.” These profound challenges demand bold action.

Quest for revenue growth intensifies

Telcos are heading into 2025 with a lot on their plate. For years, operators have poured huge amounts of money into their networks, but turning those investments into real growth has been tough. The pressure to find new routes to revenue is ever stronger.

Companies will go beyond their core connectivity and network solutions to newer areas like digital services, cybersecurity, sovereign AI cloud, edge computing and even industry-specific tools.

2025 will be a year of leaving no stone unturned to reignite growth. Those who succeed will stop working in silos and lean into collaboration, forming partnerships to create solutions to solve customers’ real problems. By tapping into the strengths of a wider ecosystem, they could open doors to fresh opportunities and staying relevant in our digital world.

Satcos becoming mainstream

Satellite companies, formerly seen as niche players, are quickly becoming a key part of telecoms. They’re no longer the only option for remote areas, but reaching many mainstream underserved markets thanks to global coverage and technological improvements. This is especially of LEO of satellites’ faster speeds, higher capacity, and lower costs.

This shift means it’s time for telcos to rethink their view of satellite companies and treat seeing them as partners rather than competitors. By working together to build hybrid networks that combine satellite and terrestrial technologies, telcos can offer seamless global services. This kind of collaboration could unlock huge opportunities for both sides.

Cybersecurity is a top priority

Telcos are the backbone of the digital economy. As networks become more interconnected, they face more risks. With the rapid expansion of connected devices and AI-driven solutions, the potential for cyber threats is increasing, alongside the demand for stronger security from regulators and customers.

Telcos can see cyber security as a box to tick for compliance or they as an opportunity to stand out. If telcos invest in innovative and reliable cybersecurity solutions, they can protect their networks, build trust and earn the loyalty of customers. Cybersecurity can be a key differentiator to drives growth and strengthens telcos’ position in the market.

Home markets, simplification

In the coming years, telcos will consolidate in key markets while re-evaluating their international operations. They shed non-core assets that consume valuable resources and become more streamlined.

At the same time, telcos will simplify their portfolios, systems and processes with the aim of becoming more agile and better aligned with market demands. By reducing complexity, they plan to improve efficiency and responsiveness in an increasingly fast-changing environment.

It’s important that telcos avoid quick, short-term fixes. They must rethink their entire approach, distinguishing between core and non-core assets. The key will be to retain their most valuable strengths – the ‘family silver’ – while optimising their overall structure for long-term success.

Data and AI are centre stage

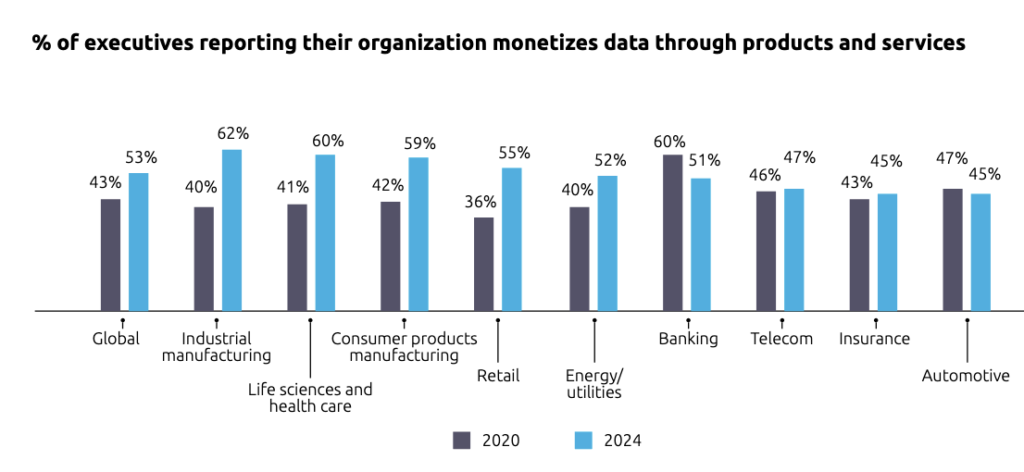

Telcos sit on a goldmine of data, but have largely failed to turn it into real value. In 2024, they ranked lower than eight out of the 10 industries Capgemini recently surveyed* (Government/public sector is left off the graph below): in 2020 they were at the forefront. Telcos will refocus on data and AI in 2025, making them central to improving operations, cutting costs, personalising customers’ experiences and unlocking new revenue streams.

Source: Data-powered enterprises: The path to data mastery (page 19) published by the Capgemini Research Institute, 2024

To achieve this, they need to build a strong data foundation, starting with a comprehensive data estate then execution. The must scale AI and adopt a fail-fast, learn-fast approach to keep up with the pace of change.

The year ahead represents an opportunity for telcos to redefine their value propositions. By prioritising innovation, simplifying their businesses and embracing the latest technology, such as AI/Generative AI, the industry can overcome challenges and set a course for long-term growth.

The 2025 imperative is clear. Reimagine the business model to ensure that past investments deliver meaningful returns and pave the way for a more dynamic and resilient future.

*This report is based on the findings of an industry survey of 500 business executives and 500 data executives from 500 organizations across 12 countries. All organisations had annual revenue above $1 billion. Executives surveyed were director-level and above and were selected from across business and data functions.

The author, pictured below, is Praveen Shankar, Global Telecom Industry Leader at Capgemini