The two infrastructure providers are teaming up to improve the interoperability of their complementary offerings.

Swisscom and SIX provide open finance offerings that can be used independently in the market.

This cooperation will make it easier for providers and consumers of financial services to use open finance and so strengthen the Swiss financial sector, they say.

New business models

Open finance is expected to play a key role in established and new business models. Over the past few years, Swisscom and SIX have each developed open finance solutions to create opportunities for companies.

Swisscom has focused on integration, while SIX has specialised in a uniform participation contract and in structured and standardised auditing of third-party providers.

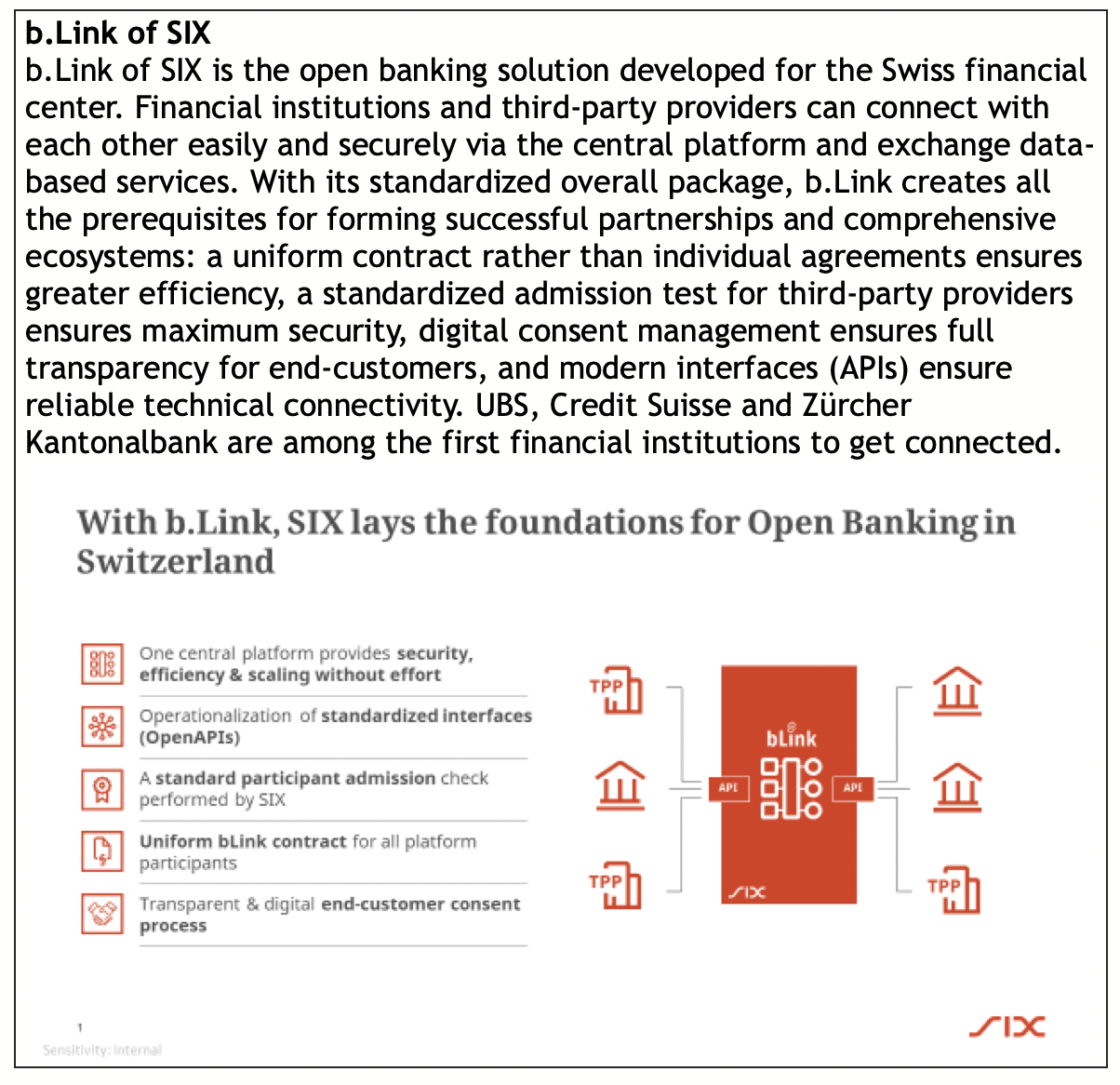

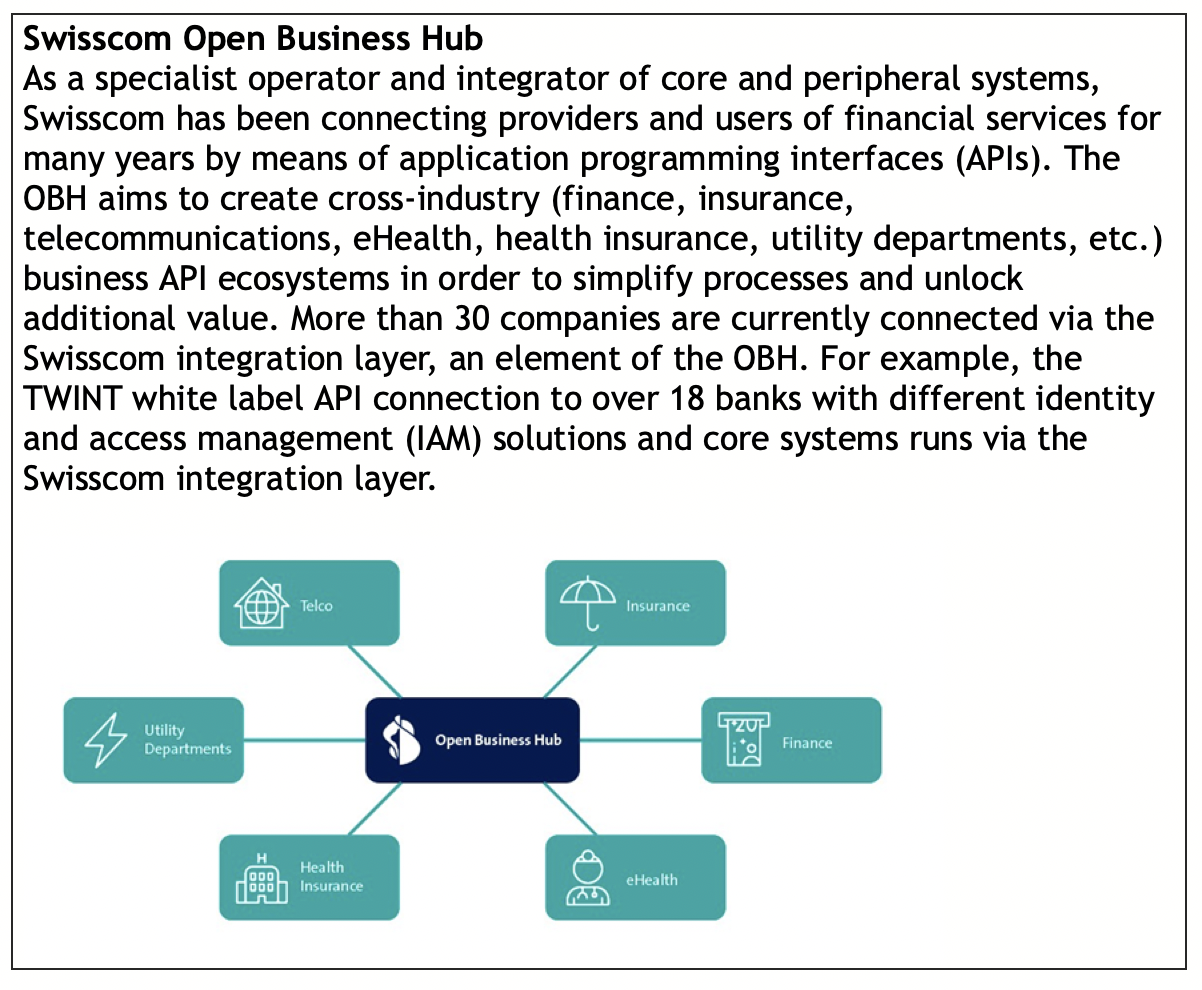

Through this technical cooperation, the two companies are seeing increase the compatibility of their hubs (see graphics below) to offer the market an interoperable and holistic end-to-end solution to support open finance.

Scale and standards

SIX and Swisscom are jointly addressing two key challenges: the lack of standardisation when it comes to integrating third-party providers into financial services providers’ systems; and the inability to connect multiple third-party providers for the same use case in a scalable way.

Swisscom offers an integration layer to support this, which companies can use to connect their systems efficiently with Swisscom’s Open Business Hub (OBH shown below) – and in the future, therefore, with SIX’s b.Link. supplementing its offering with the b.Link digital consent management tool, which handles the technical process via which end-customers give consent for their data to be used.

SIX is responsible for testing third-party providers and connecting them to b.Link.